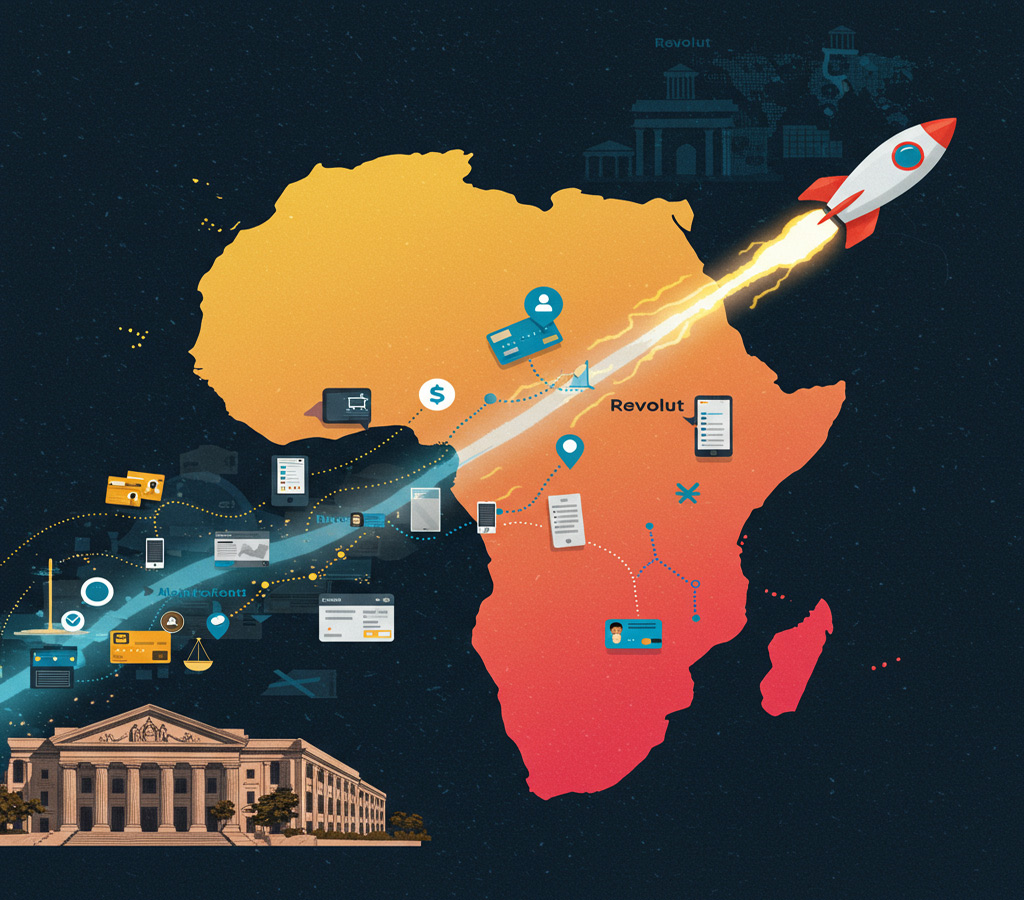

Revolut’s Leap: Pan-African Potential and Disruption 🚀

As Revolut begins its expansion on the African continent by applying for a banking license in South Africa 🇿🇦, Morocco 🇲🇦 could well be the next step. Amine Mekkaoui, expert in fintech and digital transformation and Sales Director Africa & Middle East at PayTic, deciphers the opportunities this would represent for the financial ecosystem in Morocco but also the risks of disruption for historical players.

Revolut has officially filed an application for a license in South Africa 🇿🇦, confirming the growing interest of international neobanks in emerging African markets 🌍. A bold strategic choice in a context where several major banks (Barclays, BNP Paribas, Société Générale, Crédit Agricole, Standard Chartered…) have recently reduced their exposure to the continent due to lack of profitability 📉.

Morocco 🇲🇦, with a growing banking rate 📈, a structured regulator and a mature banking sector, could constitute a logical next step. The hypothetical arrival of a player like Revolut would entail several major systemic consequences.

First, it would profoundly redefine the banking experience 🏦. Revolut offers a fully digital customer journey 📱, instant visualization of expenses 📊, intelligent alerts 🔔 and dynamic virtual cards 💳. Faced with this, Moroccan banks, often still focused on physical branches and poorly ergonomic digital platforms, would be pushed to invest massively in redesigned and fluid omnichannel journeys.

Secondly, this arrival would exert significant pressure on local non-banking revenues 💰. Revolut’s aggressive offers (low-cost international transfers 💸, multi-currency cards without fees 💳, competitive currency exchange services 💱) directly affect the traditional sources of non-interest income of Moroccan banks, particularly commissions on international transactions and currency exchange fees. To retain their customers, especially younger generations sensitive to price transparency, banks would have to adapt their pricing policy, with a tangible risk of erosion of margins on their historical products.

Revolut in Morocco imminent ? 🤔

Furthermore, regulatory adaptation would be essential 📜. Bank Al-Maghrib would have to develop a specific framework adapted to hybrid models like that of Revolut, ensuring effective supervision in a fully digital environment. This would necessarily involve strengthening regulatory requirements in terms of KYC, AML and data protection in a branchless environment.

A catalyst for the Moroccan fintech ecosystem 🚀

Finally, the entry of Revolut could be a decisive catalyst for the Moroccan fintech ecosystem 💡. Faced with such an advanced technological competitor, local banks would be encouraged to strengthen their partnerships with local fintechs, stimulating the development of solutions such as open banking 🤝, account aggregation 🧮, or intelligent savings tools 🎯.

However, a major challenge would remain: technological asymmetry 💻. Faced with a neobank built on a cloud-native ☁️ and API-first architecture, Moroccan banks would have to imperatively accelerate the modernization of their historical IT systems, costly and not very agile, in order to guarantee their long-term competitiveness 🏆.

The arrival of Revolut in Morocco is probably only a matter of time. The real question remains: Who will be ready?

Source

Translated by fulbridge.com (BBA Morocco member) and adapted from L’arrivée de Revolut au Maroc, simple hypothèse ou scénario imminent

The broader perspectives: 5 key points

The Revolut Model: Banking Revolution at Your Fingertips

Revolut has established itself as a major player in fintech, disrupting traditional banking codes. Its model is based on a 100% digital customer experience, transparent pricing, and a diversified range of services, from multi-currency current accounts to budgeting tools.

The key advantages of the Revolut model are:

- Optimized user experience: Intuitive mobile application, fast account opening, and real-time financial management.

- Competitive pricing: Reduced fees on international transactions, currency exchange, and overseas withdrawals.

- Diversified service offering: Multi-currency accounts, virtual cards, budgeting tools, stock and cryptocurrency trading.

- Technological innovation: Cloud-native and API-first architecture, enabling rapid updates and the integration of new features.

- International reach: Presence in many countries, facilitating cross-border transactions.

Revolut in Morocco: Challenges and Opportunities in a Changing Market

Revolut’s arrival in Morocco would represent both an opportunity and a challenge. Morocco, with its growing banking rate and mature banking sector, is an attractive market for neobanks. However, the non-convertibility of the Moroccan dirham could complicate Revolut’s service offering, particularly in terms of currency exchange.

To successfully establish itself in Morocco, Revolut will need to:

- Adapt to local regulations, particularly regarding currency exchange and fund transfers.

- Develop partnerships with local players to facilitate access to banking services.

- Offer innovative solutions that meet the specific needs of the Moroccan market.

South Africa: A Launchpad for Revolut’s African Expansion

The choice of South Africa as the first step in Revolut’s African expansion is strategic. This country, with its dynamic economy and developed financial sector, offers a favorable environment for neobanks. Obtaining a banking license in South Africa would allow Revolut to consolidate its presence on the continent and serve as a springboard for its expansion into other African countries.

Competition and Perspectives: Africa, a Booming Market for Fintechs

Revolut is not the only fintech company interested in the African market. Other players, such as Wise, are also exploring the opportunities offered by the continent. In Morocco, traditional banks will need to accelerate their digital transformation to face competition from neobanks.

Beyond the scope: The neobank market in Africa

Sources with African Focus:

- Research and Markets:

- This platform provides market research reports, including those related to the fintech and neobanking sectors in Africa.

- They often cover regional trends and growth projections.

- Here is a link that provides information on the neobanking market, and information relating to growth in emerging markets.

- Advapay:

- This site gives good information about the neobank market, and lists some of the current top african neobanks.

Below are the 3 best neobanks and digital banks in Africa in 2024.

- Eversend. Technically, a French startup, Eversend is now one of Africa’s biggest currency exchange platforms and an all-in-one borderless money app. Offered services include virtual USD cards, personal loans, individual and group savings, donations, cryptocurrency trading, crowdsourcing, and currency conversion. It is best for multi-currency accounts.

- Kuda. Kuda is Nigeria’s first mobile-only bank licensed by the Central Bank. It offers personal and business virtual bank accounts and automatic savings. It is best for zero card maintenance fees and free transfers.

- OurPass. Launched in 2021, OurPass is a neobank for businesses revolutionising commerce in Nigeria. Being a one-click checkout company, OurPass plans to become a global business neobank.

When researching this topic it is important to understand that the african market is very diverse, and growth rates can vary wildly from country to country.